What Are Real-World Assets (RWAs) in Crypto? A Simple Explanation

Real-World Assets are things that exist in the physical world – like real estate, gold, art, company shares or government bonds. These are assets that have real value in the traditional economy.

But now, something interesting is happening: we are starting to bring these physical assets onto the blockchain. This process is called tokenization. It means turning real-world things into digital tokens that live on a blockchain. Each token represents a piece of the original asset. For example:

A building worth $1 million can be divided into 1,000 tokens, each worth $1,000. One token could give you part ownership of the building, along with the right to earn a share of rent or profits. These tokens are not just ideas – they can be bought, sold and traded like cryptocurrencies. And they are backed by real, physical things – not just code.

So, why does this matter?

Because it opens up access. Imagine being able to invest in real estate in New York, gold stored in Switzerland or a Picasso painting – all from your mobile phone, without needing millions of dollars.

RWAs aim to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi). They bring something new to the blockchain: real-world value, legal ownership, and massive investment potential.

In short, Real-World Assets bring the “real world” into the crypto world – making investing more open, flexible and global.

Why Tokenization Is Gaining Global Attention

You might be wondering – why is there so much buzz about tokenizing real-world assets (RWAs) right now? There are a few strong reasons.

1. People Want Easier Access to Real Investments

In the traditional world, investing in things like real estate, government bonds, or fine art often requires a lot of money, paperwork and sometimes connections. But tokenization makes it simple. By breaking big assets into smaller tokens, more people – even with $100 – can invest in things they couldn’t before. This is called fractional ownership and it’s a big deal.

2. Global Markets Are Opening Up

Imagine you’re sitting in India and want to invest in real estate in the U.S. or a European bond. That’s hard, slow and full of red tape.But if these assets are tokenized and you can buy them on a blockchain platform, your location doesn’t matter anymore. Blockchain opens the door to borderless investing.

3. Big Institutions Are Taking Interest

It’s not just crypto startups talking about RWAs. Some of the biggest banks and asset managers are already experimenting with tokenized government bonds, private equity and real estate. Names like BlackRock, JP Morgan and HSBC are exploring how tokenization could modernize the financial system.

4. Blockchain Makes It Cheaper and Faster

Normally, buying or selling traditional assets involves brokers, middlemen and high fees. Transactions take days or even weeks. But with blockchain, you can trade tokenized assets in minutes – directly, securely and with low costs.

5. It Creates New Opportunities in DeFi

Once an asset is tokenized, it can be used in DeFi (Decentralized Finance). That means people can lend, borrow, stake, or trade it just like a regular crypto token.This brings real-world value into DeFi, which helps the whole crypto ecosystem grow stronger and more useful.

All these reasons are why tokenization is not just a trend – it’s being seen as the future of finance. It’s faster, cheaper, more open and global. And that’s why the world is paying attention.

Top Platforms Leading the Movement

1. Centrifuge

2. Maple Finance.

3. Ondo Finance.

Ondo helps tokenize real-world investment products like U.S. Treasury bonds and corporate debt. It aims to bring safe, yield-generating assets to crypto users.

4. Goldfinch

Goldfinch focuses on emerging markets. It allows users to lend capital to businesses in places like Africa and Latin America – backed by real-world assets and local partners. It’s a powerful example of how RWAs can be used to improve access to capital in underserved regions.

5. Chainlink (for Infrastructure)

Benefits of Tokenized Real-World Assets

Tokenizing real-world assets (RWAs) isn’t just a cool idea – it brings real, powerful benefits for both investors and businesses. Let’s break down the key advantages in easy terms.

1. Fractional Ownership = More Access.

In the traditional world, owning real estate, gold, or artwork usually requires big money. But with tokenization, one big asset can be split into many small tokens. This means regular people can invest in things that were once only for the rich – even with small amounts like $100.

2. 24/7 Markets

Traditional markets are closed on weekends or after hours. But tokenized assets, running on blockchain, can be bought and sold 24/7, just like crypto. This gives people more freedom to trade whenever they want.

3. Faster & Cheaper Transactions

Usually, buying or transferring ownership of a house, bond, or fine art takes days or weeks – and involves lawyers, brokers, and high fees. Tokenized assets use blockchain to cut out the middlemen, making transfers fast, cheap and secure.

4. Transparency & Security

Every tokenized transaction is recorded on the blockchain. That means it’s verifiable, tamper-proof and transparent. You can track ownership and history in seconds – no hidden surprises.

5. More Use Cases in DeFi

Once an asset is tokenized, it’s not just sitting idle. You can use it in DeFi – like lending it, borrowing against it, staking or earning interest.This creates new ways to earn from your assets.

6. Global Reach

Anyone with an internet connection and a crypto wallet can now access high-value assets from anywhere in the world.No need to be in the same country or work with local banks the blockchain connects everyone.

These benefits are the reason RWAs are being called the next big step in crypto. It’s not just about digital coins anymore – it’s about turning real-world value into global, open financial tools.

Challenges of RWA Adoption

1. Regulation is Still Unclear

Governments around the world are still figuring out how to deal with tokenized assets.Are they securities? Who can issue them? What laws apply? Right now, the rules are not clear and that creates legal risks – both for platforms and investors.

2. Trust and Verification

3. Limited Liquidity

Compared to Bitcoin or Ethereum, many tokenized assets don’t have a big market yet. That means it might be hard to sell your tokens quickly or you may not get the price you want.

4. Technical and Security Risks

Many RWA platforms are still new. Bugs, smart contract failures or even hacks can happen. As with any crypto project, there’s always a need to be cautious and do your own research.

5. Education and Awareness

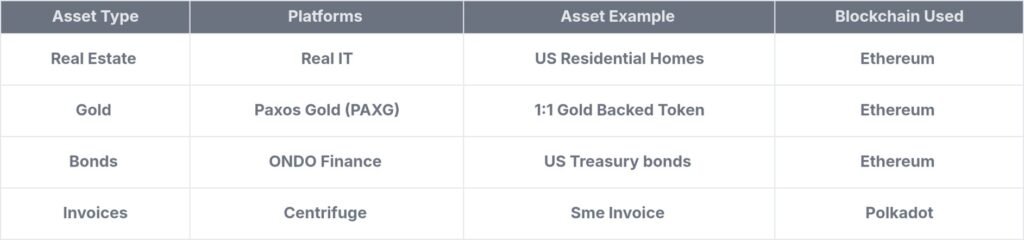

Case Studies of Tokenized Assets

To really understand how real-world asset (RWA) tokenization works, let’s look at some real-life examples. These case studies show how it’s already being used – not just as an idea, but in action.

1. U.S. Treasury Bonds on the Blockchain

Ondo Finance made headlines by bringing U.S. government bonds onto the blockchain. Normally, investing in these bonds is slow and mostly for institutions. But now, users around the world can buy tokenized versions of U.S. Treasuries and earn safe, stable returns – all through blockchain. This shows how secure, low-risk assets can be made available to a global crypto audience.

2. Real Estate Tokenization by RealT

RealT is a platform that allows you to invest in real rental properties – like homes and apartments in the U.S.Each property is turned into a set of tokens. When you buy those tokens, you earn a share of the rent, just like a landlord. The cool part? You can invest with as little as $50 and all rent payments are made in crypto.

3. Invoice Financing with Centrifuge

Small businesses often wait weeks to get paid for their invoices. With Centrifuge, they can tokenize these unpaid invoices and borrow against them using DeFi. This gives companies faster access to cash while giving investors a way to earn by financing real-world business activity.It’s a win-win for businesses and DeFi users.

4. Real Gold on the Blockchain

Platforms like Paxos Gold (PAXG) allow people to buy digital tokens backed 1:1 by real gold stored in secure vaults.You own gold – but without needing to store or transport it. And you can trade it like any other crypto token. This brings the value and trust of real-world commodities to digital finance.

These case studies prove that RWA tokenization is not just theory – it’s happening now. From real estate and government bonds to business finance and gold, the real world is stepping onto the blockchain.

What the Future Holds for Real-World Assets (RWAs)

1. More Institutional Involvement

2. Global Access to Wealth-Building Tools

3. Better Tech = Easier Use

4. Real-World Assets Meet DeFi

5. Governments Will Get Involved

Final Thought

Also Read – How DePin is replacing big tech Infrastructure