Nifty 50, Sensex & Indian Stock Market Overview

Sensex and Nifty :

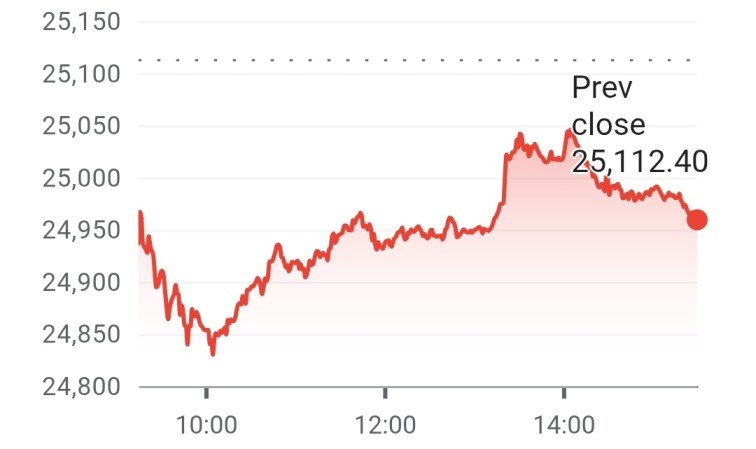

Over the weekend, reports of United States airstrikes on Iran escalated geopolitical tensions. These are leading to a gap-down opening in the Nifty. In early trade, the index rapidly slipped closer to Friday’s low, but a steady recovery saw it rebound past the 25,050 mark. However, After overall caution, the Nifty eventually settled below the 25,000 mark, ending the session with a loss of around 0.56%.

Sector Performance :

The Nifty Midcap Index outperformed, closing in the green and surpassing Friday’s high, even as the benchmark indices struggled. Given the prevailing positive momentum, this outperformance is likely to sustain longterm.

Global Market Impact :

Global markets remained cautious, with key Asian and European indices slipping into the red amid escalating geopolitical tensions, This is going to go on for the whole week now.

Stock Market Indices Performance

| Sensex | 81896.79 | -0.62% |

| Nifty | 24971.90 | -0.56% |

| BankNifty | 56059.35 | -0.34% |

Technical Analysis

From an index perspective, chasing momentum in the current tight range may not be advisable according to our analysis. The preferred strategy remains to buy on dips and lighten positions at higher levels. If we talk about in terms of levels, support has now shifted higher to the 24,800–24,700 zone, aligning with the 20-DEMA and the lower trendline of a Rising Wedge formation.

On the upside, last Friday’s high near 25,100 and then 25,200 remain key resistance zones. Traders should monitor these levels closely to structure their trades on Tuesday.

News/Updates

India’s gross direct tax collection rose 4.86% year-on-year to Rs 5.45 lakh crore till 19 June in FY 2025-26. Net collection fell by 1.39% to Rs 4.59 lakh crore.

RBI reduced the mandatory priority sector lending (PSL) requirement for small finance banks from 75% to 60%.

Adani Enterprises +0.72% : AE Commissioned India’s first off-grid 5 MW green hydrogen pilot plant in Kutch, Gujarat for supporting the National Green Hydrogen Mission.

Oil India +1.57% : Brent crude prices up 15% since early June could boost Oil India’s net realizations and earnings, potentially adding Rs 3.5-4 per share to EPS for every US$1/bbl increase.

BSE +3.24% : Likely to be included in Nifty 50 and Nifty 100 indices, meeting eligibility norms despite being listed only on NSE.

NTPC : Plans to raise up to Rs 18,000 crore through issuance of non-convertible debentures NCDs or bonds via private placement in domestic markets.

Bharat Forge : Selected as L1 bidder to supply over 4 lakh 5.56×45 mm close quarter battle carbines to the Indian Army, with an order value of around Rs 2,000 crore.

IndusInd Bank : Launched five new PIONEER branches, expanding its wealth management business to enhance client services.

Indian Goverment plans to repurpose 13,348 abandoned oil wells for geothermal energy, starting with a 450 KW pilot project by IIT Madras in Rajasthan.

Top Gainers And Losers

| Company | Price | Gains |

| TRENT | 6120.00 | ⬆️ 3.77% |

| BEL | 420.90 | ⬆️ 3.10% |

| HINDALCO | 661.40 | ⬆️ 1.89% |

| BAJFINANCE | 915.50 | ⬆️ 1.16% |

| ADANIENT | 2472.00 | ⬆️ 0.96% |

| Company | Price | Loss |

| INFY | 1584.00 | 🔻2.40% |

| LT | 3583.70 | 🔻2.14% |

| HCLTECH | 1703.20 | 🔻2.11% |

| HEROMOTOCO | 4253.10 | 🔻1.97% |

| M&M | 3135.00 | 🔻1.55% |

Disclaimer – Investments in securities market are subject to market risks. We do not advise you to invest, you should seek the advice of your financial advisors before investing

Hot Picks

| Stocks | % Gain/Loss | HOT News |

| GAIL | 1.60% | Announces ₹844 crore capex to increase pipeline capacity by 2.5 MMSCMD, taking total to 19.9 MMSCMD. |

| Reliance Infra | 1.52% | Closed 1.5% higher after settling its ₹273 crore debt with Yes Bank. |

| Solar Industries | 0.46% | Subsidiary secures ₹158 crore order from Ministry of Defence for supply of defence products; stock ends flat. |

| Zee Entertainment | 12.46% | Expects digital business to break even in FY26, with margins rising to 18–20% from 14.6% in FY25; stock jumps over 12%. |

| BEL | 3.10% | Secures ₹585 crore orders for fire control and sighting systems; stock hits all-time high, gaining over 3%. |

Subscribe Our Newsletter to Stay Informed