Introduction

Bitcoin is great for security and decentralization, but it’s not built for speed. It can only handle a few transactions per second and fees can get very high when the network is busy. This makes it hard to use Bitcoin for small and everyday payments – like buying tea – coffee or sending money instantly.

That’s where Layer-2 solutions come in.Layer-2s are built on top of Bitcoin. They help make Bitcoin more faster and cheaper to use. Some popular examples are the Lightning Network & Stacks and a new one called Ark. These tools allow people to send Bitcoin quickly, pay low fees, and even build Apps using Bitcoin Tech.

Layer-2 solutions are not just upgrades — they are lifelines for blockchain scalability.

In the last couple of years, these Layer-2s have started to grow. Many Exchanges and Wallets are adding support for them. Some countries like El Salvador are using Lightning for everyday payments. Developers are also creating new ways to use Bitcoin beyond just holding it for long time.

But here’s the big question: Can these Layer-2s survive long-term? Are they just a cool idea or can they really work at scale?.

This article will explore that. We’ll look at how these Layer-2s work, how they make money, who supports them and whether they can keep growing. We’ll also talk about the potential risks and what needs to happen for them to succeed in future.

Why Does Bitcoin Even Need Layer-2s?

To understand why Bitcoin Layer-2s matter, We first need to see the problem with Bitcoin itself.

Bitcoin is slow. It can only handle maximum about 7 transactions per second. That’s very low compared to systems like Visa and others, which can handle thousands. Also, when many people try to use Bitcoin at the same time, the transaction fees go up a lot ~ sometimes even $20 or more just to send one transaction. This makes it hard for people to use Bitcoin for small payments at stores or other places.

This problem is part of Bitcoin’s design and structure. Bitcoin focuses on being more safe and decentralized. It doesn’t want to make the blocks too big or the network too fast, because that could weaken its security or make it harder for people to run their own nodes.

But this trade-off comes with a price: Bitcoin doesn’t scale well. That’s where Layer-2s comes.

So what are Layer-2s?

Layer-2s are similar like extra roads built on top of the main Bitcoin highway. Instead of putting every transaction directly on the Bitcoin blockchain, Layer-2s process them off-chain, then settle the final result on the main chain. This means that you can send Bitcoin faster and cheaper, without changing the base layer.

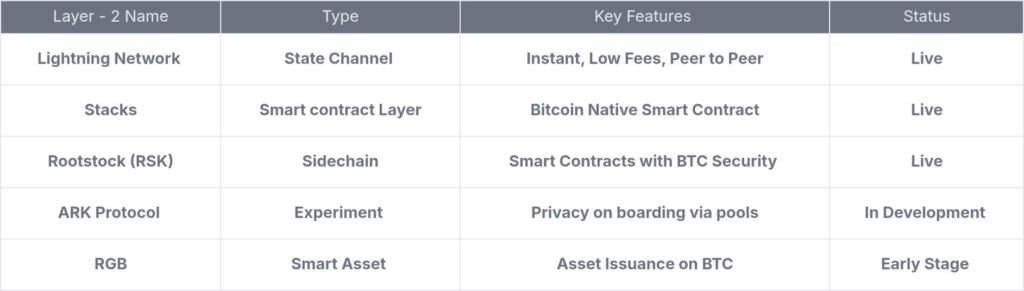

But different Layer-2s do this in different ways:

- Lightning Network uses payment channels between users.

- Stacks adds smart contracts to Bitcoin.

- Ark (new project) focuses on privacy and quick off-chain payments.

In short, Bitcoin needs Layer-2s to grow beyond “store of value” and become useful for fast, low-cost everyday payments.

Bitcoin Layer-2s – Key Insights

| Aspect | Details |

| What Are Bitcoin Layer-2s? | Secondary networks built on top of Bitcoin to improve speed and lower fees. |

| Why They Matter | Make Bitcoin more usable for daily transactions and global adoption. |

| Popular Examples | Lightning Network, Rootstock (RSK), Liquid Network |

| Economic Model | Rely on transaction fees, adoption incentives, and integration with wallets. |

| Current Challenges | Low usage, complexity, lack of user-friendly tools, uncertain monetization. |

| Long–Term Risks | Sustainability of funding, centralization risks, regulatory uncertainty. |

| Conclusion | Potential is high, but real success needs mass adoption and better UX. |

Meet the Main Bitcoin Layer-2s: How Do They Work?

There are a few different Layer-2 solutions built on top of Bitcoin. Each one tries to solve a specific problem – like making payments faster, adding smart contracts and improving privacy & security.

Let’s take a look at the most well-known ones:

1. Lightning Network

This is the most popular Bitcoin Layer-2 till now. It works using payment channels.

Here’s how it works in simple terms:

Two different people open a channel between them and put some Bitcoin into it. Then they can send payments to each other instantly, with very low fees. These payments happen “off-chain,” so they don’t slow down the entire Bitcoin network.

Only when the channel is closed does the final result get added to the Bitcoin blockchain.

- Good for: small and fast payments.

- Used by: Strike, Wallet of Satoshi, and many bitcoin apps.

- Problem: Slightly tough for new users, and hard to route larger payments.

2. Stacks

Stacks is very different from Lightning Network. It brings smart contracts to Bitcoin – like what Ethereum has. Developers can build apps, NFTs, and even DeFi tools by using this network.

It has its own token, STX, which is used for gas fees and staking. The smart contracts are secured by Bitcoin through a process called “Proof of Transfer.”

- Good for: building apps and smart contracts.

- Used for: NFTs, DeFi and Bitcoin-based apps.

- Problem: Not used for fast payments like Lightning Network.

3. Ark

Ark is a new comer and experimental Layer-2. It’s built to offer private and fast Bitcoin payments without needing payment channels like Lightning Network.

Users don’t need to be online all the time or no need to manage complex setups. Ark is still early, but it could make Layer-2s easier and more private in the future.

- Good for: fast and private payments.

- Still new: early-stage and not widely used yet.

- Problem: not battle-tested like Lightning Network.

How Do These Layer-2s Make Money? Are They Sustainable?

Building fast and cheap networks is great – but here’s the big question:

Who pays to keep them running? And more importantly, who earns from them?

Let’s break it down.

Lightning Network is Fast, But Is It Profitable?

Lightning is great for fast and cheap Bitcoin payments. But running a Lightning node (the thing that powers the network) isn’t easy process – and it’s not very profitable right now.

- Node operators earn very small fees from routing payments.

- Those fees are tiny — often less than a penny per transaction.

- To make real money, you need lots of liquidity and uptime with technical knowledge.

But most people run Lightning nodes for the mission, not the money. That’s okay for now, but it could be a problem if we want the network to grow at a global level.

Stacks: A Token-Powered Ecosystem

Stacks uses its own token STX, STX to power smart contracts and apps. People pay STX to use the network and some of that goes to developers and stakers through a system known as “stacking”.

- STX has real utility in the Stacks ecosystem.

- Developers can earn from apps, DeFi fees or some token rewards.

- Stacking rewards give people a reason to hold and support this network.

Stacks looks more sustainable than Lightning in some ways – especially for builders and investors. But it’s still young, and it’s adoption is not as big as Ethereum.

Ark: Too Early to Predict

Ark is still new and doesn’t have a token. It focuses on privacy and ease of use, not profit — at least for now.

- There’s no clear Economic/Revanue model yet.

- It may rely on service providers or some other incentives later on.

It’s promising, but we’ll have to wait and see if it can be sustainable without clear rewards for those who support it or use it.

The Big Picture

All Layer-2s are still in early stages. They work technically, but many don’t yet have strong money models. For long-term survival, they need to:

- Offer real rewards to users and node operators.

- Keep fees low and stay still profitable.

- Attract enough users to grow sustainably.

Adoption vs Sustainability: Is the Growth Real?

Layer-2s sound great on paper – fast payments, low fees, smart contracts, privacy and security. But are people actually using them? And is that usage enough to keep them alive in the long time of period?

Let’s take a look at the current adoption.

Lightning Network: Growing, But Not Exploding

Lightning has been around for a few years now. It’s used by some apps like Strike, Cash App and Wallet of Satoshi. Some countries, like El Salvador, even use Lightning for day-to-day easy payments.

But here’s the truth:

- Most Bitcoin users still don’t use Lightning.

- It has around 5,000–6,000 active nodes.

- Total capacity is over 5,000 BTC, but growth has slowed.

- Many users find it confusing and too technical.

So while it’s working, it’s not yet mainstream. It’s like a great product that hasn’t gone viral.

Stacks: Builders Are Active, But Users Are Few

Stacks has attracted developers who are building DeFi apps, NFT platforms, and Bitcoin-based tools.

But:

- Most users are still on Ethereum or Solana for these things.

- STX has grown, but it’s ecosystem is still small.

- Apps are improving, but mass adoption hasn’t arrived yet.

Stacks has a strong vision, but it needs more users to become sustainable.

Ark: Just Getting Started

Ark is still new comer, so adoption is hard to measure right now:

- It’s mostly being tested by several devs and researchers.

- No real usage data arrived yet, but still excitement is growing in privacy-focused communities.

Like Lightning in its early days, Ark needs time, tools and education in users to grow.

So, Is Adoption Enough?

Right now, no Bitcoin Layer-2 is “mainstream.” They’re all still early in early stage – even Lightning Network. Growth is slow and steady but not explosive. But that’s normal for deep infrastructure projects.

Adoption will take time. What matters is:

- Are the tools improving?

- Are more wallets and apps adding support?

- Are builders getting support and funding?

The Biggest Challenges Ahead

Even though Bitcoin Layer-2s have a lot of potential, they also face some serious challenges. If these issues aren’t solved, they could slow down growth — or even stop it altogether.

Let’s break down the main problems.

1. User Experience Is Still Too Hard

Many people find Layer-2s confusing. Setting up a Lightning wallet, managing channels, or using Stacks apps can feel too technical.

- Most users want simple, “tap-and-go” experiences.

- But today, using L2s still feels like early internet days.

For mass adoption, the experience needs to be as easy as PayPal or Venmo — not something only developers can use.

2. Liquidity and Network Effects

For Layer-2s to work well, they need lots of users, liquidity, and connections.

- Lightning needs enough BTC in payment channels.

- Stacks needs users for its apps and token economy to work.

- Ark needs adoption from wallets and exchanges.

3. Lack of Clear Incentive

Why should someone run a Lightning node or build on Stacks? The incentives are still unclear or weak.

- Running a Lightning node often isn’t profitable.

- Building on Stacks is promising, but there’s still limited traffic.

- Ark doesn’t yet offer any rewards to participants.

Long-term success depends on rewarding people who support the network — with either money, tokens, or reputation.

4. Education and Trust

Many Bitcoin users still don’t trust Layer-2s. They worry about losing funds or getting stuck in a system they don’t understand.

To fix this, we need:

- Better education and onboarding

- More audits and open-source tools

- More trusted apps that “just work”

What’s Next for Bitcoin Layer-2s? A Look Into the Future

Bitcoin Layer-2s are not perfect today – but they are a big step forward for Bitcoin’s future.

Right now, they’re still early:

- The tools are being built.

- The users are slowly coming.

- The ideas are strong, but the systems are still growing.

But the goal is clear:

To make Bitcoin more useful, faster and easier to use – without changing its core structure

What Needs to Happen Next?

For Layer-2s to really succeed, we’ll need:

- Better Apps and Wallets that work smoothly for non-tech users.

- More education so people understand how to use these tools.

- Incentives for developers and node operators so they keep building.

- Real-world adoption, not just by Bitcoin fans, but by businesses, merchants and everyday people.

If these all things come together, Bitcoin Layer-2s could unlock a whole new phase for crypto – where Bitcoin becomes more than just “digital gold.”

Final Thoughts

Layer-2s are like the early internet – a bit rough, but full of potential. They’re not hype anymore. They’re real, growing and here to stay for long run.

The next few years will tell us whether they can survive, scale and shape the future of money. But one thing is clear, they’re one of the most important developments happening in Bitcoin today.